Industry News

Core PGAMA articles

Change in the National Partnership

In January, 2021 our Executive Committee participated in a presentation with PRINTING United Alliance ( PrUA ) President, Ford Bowers. In it, Bowers outlined his vision in regard to the affiliate, national relationship. While we understand Ford’s reasoning, it is a direction that we believe would eventually eliminate or reduce our capacity to provide many of the local services, industry connections, networking, and value that is the core of our relationship with you, our members. Additionally, the proposal called for a commonality of services offered across the country which, in our opinion, doesn’t recognize the unique value that each of the affiliates bring to their members.

After a thorough review of the Printing United Alliance (PrUA) proposal, The Board of Directors of PGAMA, voted unanimously to reject the proposal and instead asked that both parties go back to the agreement in place, or craft a new mutually acceptable agreement. That offer was rejected by PrUA on March 12, 2021 and they unilaterally ended our relationship as of April 30, 2021.

What does this mean to PGAMA members?

Services that have been provided through our national affiliation including Environmental Health and Safety and National Government Affairs and Advocacy, are of importance to some of our members and be assured that steps are already being taken to replace and even enhance such services. Existing programs like PrintEd, Wage and Benefit Survey, FSC and SFI certification, Printers 401K, Printers Disability Trust and Print Access, as well many of our buying programs and member benefits, are under the auspices of the regional print associations, not the national organization, and will remain so.

You have our pledge of a redoubled effort to continually search for ways that we can support your company and bring additional value to your membership. As always, we encourage you to connect with PGAMA for any business and industry questions and concerns.

PGAMA was an early proponent of the merger of PIA and SGIA into Printing United Alliance and we were excited thinking about the possibilities that would result from the bringing together of these iconic brands and welcome into our organization print communities, that had, until this point, never had regional affiliation or representation. PGAMA continues to support the concept of a united industry on a local, regional and national level and hopes that somehow the path that PrUA has chosen is only temporary.

We are in the process of scheduling a webinar to answer any and all questions you may have. You can send your questions ahead of time to me,This email address is being protected from spambots. You need JavaScript enabled to view it.or call my cell 443-799-6767.

Very truly yours,

Jay Goldscher, President of PGAMA

Employee Retention Tax Credit

This information comes from PGAMA member,This email address is being protected from spambots. You need JavaScript enabled to view it., CPA, CVAThe Becker Group/TMDL CPA’s

Dir line 443-569-4616,This email address is being protected from spambots. You need JavaScript enabled to view it.Employee Retention Tax CreditAnother Federal Government program to help employers through the pandemic by providing a significant payroll tax reduction based on # of employees in a quarter.Eligibility for 2021:1)Sales reduction:-To receive a tax credit based on # of employees in Q1 2021,must have at least a 20% decrease in sales (same definition of sales as for PPP 2)in either Q4 2020 vs Q4 2019, or Q1 2021 vs Q1 2019.-To receive a tax credit for Q2 2021, must have at least a 20% decrease in sales in either Q1 2021 vs Q1 2019, or Q2 2021 vs Q2 2019-To receive a tax credit for Q3 2021, must have at least a 20% decrease in sales in either Q2 2021 vs Q2 2019, or Q3 2021 vs Q3 2019-To receive a tax credit for Q4 2021, must have at least a 20% decrease in sales in either Q3 2021 vs Q3 2019, or Q4 2021 vs Q4 20192)# of employees must be less than 5003)If donot meet the sales reduction requirement, can also be eligible if company was required to partially or fully suspend operations in 2020 by order of your state or local government.Tax Credit:Calculation: Up to $7,000 per employee per quarter based on quarterly gross wages for each employee per quarterly payroll tax Form 941 plus employer paid health care costs (maximum payroll cost of $10,000 at 70%)Example: if 20 employees are reported on Form 941 for Q1 2021 that each earn at least 10,000 including health care costs for the quarter, then credit for Q1 2021 is $140,000 ($200,000 x 70%,or 20 x $7,000).If payroll stayed the same for each quarter in 2021, then thetotal credit for 2021 will be $560,000 ($140,000 x 4 quarters).How to access the tax credit:-The credit is a line item on the quarterly payroll tax return Form 941. This credit is refundable and will paid to your company by the IRS.Or, in anticipation of receiving the credit, you may stop remitting payroll tax deposits in a quarter up to the projected credit amount, therefore $$ will be obtained immediately. Also, any available credit can be applied to the next quarter to allow for stoppage of payroll tax deposits in the next quarter in lieu of waiting for an IRS refund check.Also, if payroll tax deposits are stopped and there is still a projected quarterly credit available, you can file Form 7200 to receive the credit in advance of filing Form 941.Other Rules:-If you acquired a company in 2021, can include acquired company’s sales into the 2019 quarterly sales calculation.-No double-dipping of wages and health care costs: If $10,000 is used for the quarterly credit calculation, then cannot use the same $10,000 for the PPP2 loan forgivenesscalculation.Note: it is expected that this limitation will not adversely affect the forgiveness calculation since there are 24 weeks available in the covered forgiveness period with the requirement that at least 60% of the loan amount be used for payroll costs, and supplier costs are now eligible to help fulfill the 40% requirement. Also, wages in 2021 prior to the receipt of thePPP2 loan can be used in full for the credit calculation.-Covid related sick leave reimbursed by the IRS is excluded from wages for the credit calculation.Eligibility for 2020:-Must have a 50% decrease in sales vs 2019 (quarter vs quarter).-Maximum Credit is $5,000 per employee per year (not per quarter) and calculated at a maximum payroll cost per employee of $10,000 x 50%.-Can file retroactively by amending Form 941 and filing Form 941-X. Wages submitted for PPP1 loan forgiveness can be modified to take maximum advantage of the creditandloan forgiveness without resubmitting the forgiveness application.Note: the above rules for 2021 are subject to change upon guidance yet to be released by the IRS (as of March 22, 2021).

Year-End Tax Planning

This year has been an interesting and challenging year. Due to Covid-19 there have been economic stimulus payments, Payroll Protection Loans, and new regulations by the CARES Act, the Disaster Act, and SECURE Act. Many of these rule changes have affected taxpayers by extending previous expiring provisions, changing retirement rules, charitable contribution deductions, and much more.

We will highlight some year-end tax planning that may help you to lower your tax bill for 2020.

• NOL-If you expect a business loss in 2020, you will be able to carry back 100% of the loss to the prior 5 years. If you carry an NOL into 2020, you can claim a deduction for 100% of your 2020 taxable income.

• MD Tax Benefit -MD has implemented a workaround for the $10,000 itemized deduction state tax limitation. You may elect to be taxed at the entity level for an S Corp, Partnership or LLC. Taxes will need to be paid before year-end. Please contact us for further information.

• Establish a Retirement Plan -If you do not already have a retirement plan set up for your business this is a good time to consider your options. The SECURE Act offers an additional incentive for establishing a retirement plan in 2020 in the form of a credit up to $5,000. Please let us know if you would like to discuss the many options available to small businesses.

• Bonus Depreciation -100% first-year bonus depreciation is still available for qualified new and used property that is acquired and placed in service in 2020. Consider making any additional acquisitions between now and the end of the year.

• Heavy SUVs, Pickups or Van Depreciation -100% bonus depreciation is allowed on qualified vehicles used over 50% in your business. It is available to SUVs, pickups or vans that have a Gross Vehicle Weight over 6,000 pounds.

• First-Year Depreciation of Cars, Light Trucks & Light Vans -There are still limits on new and used passenger vehicles acquired and placed in service in 2020, the limits are $18,100 for Year 1, $16,100 for Year 2, $9,700 for Year 3 and $5,760 for Year 4 and after.

• Section 179 Deduction -For qualifying property placed in service in 2020, the maximum deduction is $1.04 million. The phase-out threshold in $2.59 million.

• PPP Forgiveness -As of this letter, the IRS wants to treat the expenses paid by the loan proceeds as non-deductible, therefore creating taxable income on the forgivable portion of your loan. This is counter to the intent of the forgivable loan but only Congress can stop this. We are hopeful that Congress will act within the next month or two ... Stay tuned!! Also, to certify the forgivable portion of your loan with your bank, you have 10 months from the end of your selected covered period (8 weeks or 24 weeks after loan proceeds were received). For most companies, this will be around April or August 2021.

Questions? Contact Bart Krupnick 44-569-4624 or This email address is being protected from spambots. You need JavaScript enabled to view it.

PrUA Comments on VA Covid-19 Final Standard

September 24, 2020

Thank you for the opportunity to provide comments on the Commonwealth’s Proposed Final Standard, Infectious Disease Prevention: SARS-CoV-2 Virus That Causes COVID-19. The PRINTING United Alliance (PrUA) represents the interests of facilities engaged in the production of products through screen, digital, flexographic, and lithographic printing processes. This includes facilities engaged in garment decoration, production of membrane switches, decals, all types of signage, as well as paper products, such as books, pamphlets, and other marketing materials. Our industry is comprised primarily of small businesses, with about 80 percent of establishments employing 20 or fewer people.

We understand and share the concern of the Commonwealth regarding the safety of the workforce during this time of pandemic. However, we believe, it must be tempered with common sense and recognition of costs associated with the compliance of a regulation. We believe that current regulations, as adopted and enforced by VOSH, offer sufficient protection for the workforce for infectious diseases, including the current SARS-CoV-2 Virus.

We do not recommend adoption of a permanent standard addressing this one particular issue. PrUA agrees with the position stated by the U.S. Department of Labor’s Occupational Safety and Health Administration that existing statutory and regulatory tools are protecting America’s workers and that neither an emergency temporary standard nor a permanent regulation is necessary at this time.

We believe that VOSH has adopted all the relevant federal standards and already has the authority and regulatory oversight to address safety and health issues associated with this pandemic situation. An additional regulation is unnecessary and would impose significant costs on businesses at a time when many cannot afford it as they are on the verge of bankruptcy or in a situation where their income is significantly lower than the pre-pandemic period. Many of our members are reporting that sales and income are between 40-60% of pre-pandemic levels.

One of our overarching concerns with the adoption of this standard is that there is no end date or a provision addressing its suspension when the pandemic ceases. It appears that the requirements of this standard would become continuously applicable, and this is not an acceptable situation. The lack of clarity raises critical questions such as - would this standard be enforced only during a pandemic that involved this specific virus? Who would declare that this standard applies, and most importantly, who would determine when the provisions no longer apply as a pandemic may be over? For these reasons, PrUA firmly believes that VAOSH’s current regulatory programs adequately address workplace exposures, including exposures to this virus strain.

Another concern is the static nature of the requirements. While the standard does reference the use of guidelines issued by the Center of Disease Control (CDC), and since the temporary rule was adopted, several recommendations by the CDC have changed and conflict with the requirements in the temporary rule. There are no provisions in the regulation that address what a covered entity would be required to do when another recommendation is revised by the CDC that would conflict with the regulation. As the pandemic continues, it is reasonable to expect that the CDC will issue updated guidance as new information regarding this virus, as well as others, is discovered. How will the average small business determine if they are to follow the requirements specified in the regulation versus the most recent and effect guidance issued by the CDC? And most importantly, how will these conflicts be addressed during an inspection and possible enforcement action?

In order to make this standard permanent, VOSH needs to provide justification that the transmission of the virus in the workplace is such that imposing such an onerous regulation as this one is necessary to protect the health and wellbeing of workers. VOSH is compelled to show that in the absence of a regulation of this nature would cause widespread infections as compared to its existing set of regulations.

In examining the latest statistics for COVID-19 infections, the number of new cases, percentage positivity (the number of cases confirmed as a ratio of the amount of testing), and hospitalizations is clearly on a downward trajectory. Based on the actions taken to address the spike in infections that recently occurred, it appears that the increase was due to people congregating in social settings and not due to being exposed by a coworker. Other recent outbreaks occurred in correctional facility, healthcare, and educational settings. The infection data also shows a higher concentration of infections occurring in Northern Virginia. Of course, some of these locations are “workplaces” which points to the fact that workers need to take precautions to prevent becoming infected.

Because these outbreaks occurred since the imposition of the temporary standard, the requirements in it had little outcome on the results. The publicly available data is not detailed enough to discern the number of “workers” infected verse the general public or other populations. VOSH has access to more specific information and must present compelling evidence that a standard of this nature is warranted. VOSH should be able to show infection rates of workers that occurred before the temporary standard was imposed versus infections after the standard went into effect to support making the standard permanent.

Likewise, VOSH also needs to show that the requirements in the temporary standard, as compared to following CDC and federal OSHA’s recommendations, would be more effective at preventing transmission of the virus in the workplace. Until such time that compelling data indicating virus transmission was dramatically reduced as a result of the temporary standard can be produced, a permanent standard is not warranted.

In addition, the proposed regulation contains many provisions that are quite onerous for small businesses. We offer the following comments on the proposal itself.

Section 40 – Mandatory requirements for all employees

PrUA continues to stress that the requirement to ask employers to designate and document employees as either “very high,” “high,” “medium,” or “lower” exposure risk assumes that the small business would have a person on staff capable of making these type of subjective judgement calls. The addition of a staff person, knowledgeable in the area of infectious disease, imposes a significant economic burden. Alternately, hiring a consultant to perform this analysis also requires taking on significant economic burden and is cost prohibitive.

Section 40.B.3-8c should be deleted. The inclusion of these sections in the permanent standard is not appropriate as these requirements are personnel related and do not have a role in a safety regulation. While we agree that VOSH can develop regulations stating when employers need to notify VOSH regarding injuries and illnesses, we believe that the proposed requirements set forth in the proposed rule overstep the boundaries between development of a safety and health regulation and employment law.

Section 40.C, Return to Work, should also be deleted as these requirements also overstep the boundary between safety in the workplace and employment law.

Section 40.K.8 contains a statement “Hand sanitizers required for use to protect against SARS-CoV-2 are flammable and use and storage in hot environments can result in a hazard.” All chemicals entering the workplace must be accompanied by a Safety Data Sheet that clearly outlines storage requirements. Inclusion of this statement is not relevant as employers are required to clearly identify and store flammable materials. Sanitizers, including hand sanitizers, that are being used in the workplace will be classified as “workplace” chemicals and would fall under the provisions of the Hazard Communication Standard.

Section 60 – Requirements for hazards or job tasks classified at “medium” exposure risk

Section 60.A discusses engineering controls that facilities must undertake when employees are classified as “medium” exposure risk. The ventilation requirements listed are identical to those found in Sections 50.A.1 and 50.A.2 for health care facilities where airborne particulates of infectious diseases are expected to be encountered. Many printing operations could have employees in the medium exposure risk category, and it is important to understand that printing facilities have adopted ventilation systems appropriate for their facilities based on chemical use. The upgrading to this type of ventilation system is both unwarranted and expensive

Section 60.D discusses requirements for Personal Protective Equipment. It is unclear from the regulatory text whether Section 60.C.2 applies to employers that have already undertaken hazard assessments for PPE required in the workplace, which is required of general industry. It appears that this section was written for businesses that are not already covered by the mandatory assessment. And, if Section 60.C.2 does apply to general industry and a new hazard assessment is required, why is there an additional requirement that it be certified when that is already required? We recommend that this section be reworded to acknowledge industry sectors that are already required to conduct the written hazard assessment and conform this requirement to current regulation.

Section D.4 should be deleted as it is not a regulatory requirement but a statement of fact that should be included in a guidance document rather than a regulation.

Section 70 - Infectious disease preparedness and response plan

Implementing Section 70 requirements will create a serious economic burden for small businesses to implement. The proposal states that a person “shall be knowledgeable in infection control principles and practices as they apply to the facility, service or operation.” This proposed standard seems to require businesses to train an existing staff person and dedicate their time to this effort or hire an outside consultant to develop a plan. Again, state guidelines have been issued that provide templates that can be adopted by the business sector that does not require the use of an expert in infectious diseases. In addition, the Centers for Disease Control and Prevention have issued numerous guidelines to assist businesses with creating plans so as not to require the need to hire outside consultants. Hiring such consultants places a significant financial burden on businesses that are trying to recover from the current economic crisis.

The requirements in Section 70.C.3 are unreasonable, if not impossible, to perform by a person who is not an epidemiologist, virologist, or other public health expert. The information about transmission of the virus is changing constantly and even the CDC – upon which the entire country relies – is unable to definitely state how the COVID-19 virus is transmitted, as evidenced by posting guidance on September 18 and then removing that guidance three days later. In addition, the incidence of COVID-19 cases changes constantly. Accordingly, it is unreasonable to expect that a designated person to be personally responsible for knowing the transmission, travel, and other exposure risk information required in Section 70.C.3.a.

Further, the requirement of Section 70.C.3.b-c is extremely complicated and filled with potential violations of federal law under the Americans With Disabilities Act, , Age Discrimination and Employment Act, the Genetic Information Nondiscrimination Act , HIPPA laws, and Equal Employment Opportunity Commission regulations. Requiring such information gathering and analysis puts the company and the designated person at very high risk of liability for violating these laws.

The requirements of Section 70.C.4-9 are not necessary to include in a permanent rule. The heightened requirements related to COVID-19 are covered in the temporary rule. Once the pandemic has resolved, workplaces will be organized and structured in a manner that fulfills federal OSHA requirements and will address the general duty to provide a safe workplace. It is unnecessary to promulgate a permanent rule about best practices, which will continue to evolve in response to surrounding conditions and the proposed requirements of the permanent rule will no longer be the most current nor best practice as written.

Section 80 - Training

We believe that training requirements as outlined are already in place for printing establishments as required by the general industry standards. The addition of any new PPE requires training. And this training is already well documented. The requirements placed in this section are duplicative and do not reflect what is required by current regulation. Therefore, for general industry, such as printing, Section 80.B.8 is redundant and unnecessary duplication of regulation. VOSH should provide a cross reference to the general industry standards so that employers understand that this requirement is already in place in the current regulations governing the use, care, and selection of personal protective equipment.

Concluding Remarks

The PRINTING United Alliance remains committed to providing the graphic communications and printing industry with resources to address safety and health issues associated with the COVID-19 pandemic. However, we do not believe that a formal safety and health regulation is either appropriate or warranted as current general industry standards are comprehensive and sufficient. This position has been validated by both OSHA and U.S. Court of Appeals for the District of Columbia Circuit actions.

Thank you for the opportunity to provide our thoughts and comments on this important regulatory initiative.

Sincerely,

Marcia Y Kinter

Vice President Government & Regulatory Information

Federal Courts Order Changes in Postal Operations

Concerns over the Postal Service’s ability to handle election mail manifested themselves again earlier this month in orders from two separate federal courts. Courtesy of Mailer's Hub

Acting on appearances

Operational changes implemented last July by newly-appointed Postmaster General Louis DeJoy, the ensuing resistance of the postal labor unions, and the ongoing disruptions caused by the COVID pandemic, combined quickly to yield a precipitous decline in service. Regardless of the facts regarding DeJoy’s intentions, and aside from whether he did not seek or did not listen to the advice of more experienced executives, the timing of his orders was ill-advised. Set in the context of questions about DeJoy’s selection, his political support for the president, and the White House’s hostility toward both the USPS and vote-by-mail, suspicions quickly grew that DeJoy’s actions were designed to carry out administration plans to harm the Postal Service and disrupt balloting by mail. In due turn, administration

opponents in postal labor and in Congress seized on the opportunity to pillory DeJoy for his actions and, by proxy, propound their criticisms of the president.

Despite assurances by the PMG and even a kumbaya statement by him and labor leaders that the USPS was ready and able to handle election mail, the wildfire of conviction spread that DeJoy was trying to torpedo voting by mail and that ballots would be late or lost in November, confirming the president’s allegations about using the mail for elections.

Blocking

On August 18, a group of fourteen state attorneys general filed suit in the federal District Court for the Eastern District of Washington against the president, postmaster general, and the Postal Service. The 120-page “Complaint for Declaratory Judgment, Mandamus, and Injunctive Relief,” filed by the states of Colorado, Connecticut, Illinois, Maryland, Michigan, Minnesota, Nevada, New Mexico, Oregon, Rhode Island, Vermont, Virginia, Washington, and Wisconsin alleged that

“…Postmaster General Louis DeJoy has recently instituted

sweeping changes that undermine the Postal Service’s ability

to provide consistent and timely service. DeJoy has called

these changes ‘transformative’ and has acknowledged that

they have ‘impacted our overall service levels.’ DeJoy instituted

these ‘transformative’ changes following repeated

statements from President Trump evincing a partisan political

motive for making it harder to vote by mail … . The ‘transformative’

changes DeJoy has implemented are both procedurally

and substantively unlawful. …”

The litigants claimed “elimination” of overtime,” “instructing carriers to leave mail behind,” “decommissioning sorting machines,” “removing mailboxes,” and “reducing operating hours,” were politically motivated and done to inhibit voting by mail. In turn, they rested much of their case on the claim that the changes constituted “a change in the nature of postal services which will generally affect service on

a nationwide or substantially nationwide basis” and that, under 39 USC 3661, the Postal Service was obligated to seek an advisory opinion from the Postal Regulatory Commission

before implementing such changes. The requested relief included ordering the USPS to halt any of the announced changes or, absent that, a ruling by the court that what the USPS is alleged to be doing is beyond its authority (consistent with the argument that the changes require a prior advisory opinion by the PRC) followed by an injunction against implementation of the alleged

changes. The suit also asserted that the alleged changes are unconstitutional in that they will “interfere with the ability of residents of the Plaintiff States to timely receive and return voter

registration forms and ballots and have their votes counted… thus depriving qualified voters of equal protection under the law secured to them by the Fifth Amendment.”Shortly thereafter, a similar lawsuit was filed in the federal District Court for the Southern District of New York by the State of New York, joined by Hawaii, New Jersey, and the cities of New York and San Francisco, while a third suit was

Mailers Hub News 2 September 28, 2020 filed (against the USPS, DeJoy, and Board of Governors chairman Robert Duncan) by the State of Pennsylvania, joined by California, Delaware, Maine, Massachusetts, North Carolina, and the District of Columbia. Overall, eleven suits were filed.

Order one

On September 17, Judge Stanley Bastian in Yakima (WA) is-sued a nationwide preliminary injunction against the USPS. As reported by the Associated Press, the judge accepted the states’ assertions, finding that “The states have demonstrated the defendants are involved in a politically motivated attack on the efficiency of the Postal Service” and that the changes created “a substantial possibility many voters will be disenfranchised.” The judge’s order directed the Postal Service to stop implementing the “leave behind” policy, to treat all election mail as First-Class Mail, to reinstall any mail processing machines needed to ensure the prompt handling of election mail, and to inform its employees about the requirements of his in-junction. During the hearing, the Justice Department attorney representing the USPS argued unsuccessfully that “There’s been a lot of confusion in the briefing and in the press about what the Postal Service has done. The states are accusing [the USPS] of making changes [it has] not in fact made.” The attorney also insisted that the states were required to bring their challenge not in court, but before the Postal Regulatory Commission, but the judge rejected that as well, saying there was no time for that with the election just seven weeks away. In response, the USPS said it was reviewing its legal options, and repeated its readiness to handle election mail. In an unusual comment, USPS Governor Lee Moak called the notion any changes were politically motivated “completely and ut-terly without merit.”

Order two

On September 21, Judge Victor Marrero in Manhattan issued an order similar to Bastian’s, strongly concurring with the plaintiffs’ allegations. As reported by the Associated Press, Marrero’s 87-page ruling was more specific than Bastian’s 13-page order, and he cited public statements, including from the president, to explain why he can’t trust government assurances that new policies hampering mail delivery had been fully suspended: “Substantial evidence indicates that the supposed rollback of the challenged practices is either unenforced and not yet fully implemented or possibly insincere. The controversy Plaintiffs raise remains very much alive.” Continuing, he found that the defendants “have not provided trusted assurance and comfort that citizens will be able to cast ballots with full confidence that their votes would be timely collected and counted.” Instead, he said, their actions have given “rise to management and operational confusion, to directives that tend to generate uncertainty as to who is in charge of policies that ultimately could affect the reliability of absentee ballots, thus potentially discouraging voting by mail. Conflicting, vague, and ambivalent managerial signals could also sow substantial doubt about whether the USPS is up to the task.”

The judge further cited “a stunning lack of uniformity and a high level of confusion at various points in the USPS hierarchy regarding the standards to be followed by USPS employees on the ground. The Court is left with little reason to believe that the USPS policy and operational picture will be any clearer for postal employees as the November election approaches.”

Following the judge’s instructions, the parties reached agreement on most points but the USPS balked on a blanket approval for overtime from October 26 through November 6, instead saying it would be allowed based on workload and, particularly, the need to move election mail.

As with the Washington order, the USPS again said it was reviewing the ruling and that “there should be no doubt ... that the Postal Service is ready and fully committed to handling expected increased volumes of Election Mail between now and the conclusion of the November 3rd election. Our number one priority is to deliver the nation’s Election Mail securely and in a timely fashion.”

Post mortem

After information about DeJoy’s July instructions leaked out – the USPS never has the foresight to get in front of a story – the PMG and others have sought to explain, with little success, that the PMG’s directives were interpreted more strictly and severely by subordinates than intended. Using this defense apparently backfired, notably in Judge Marrero's comments about “management and operational confusion.” For example, a “mandatory stand-up talk” to employees, whose origin was not explained, but was leaked to Motherboard, stated revised circumstances:

• “Overtime. Front-line supervisors and managers will continue to schedule work hours based on workload. Overtime is authorized and instructed to be used as necessary to fulfill our mission and expeditiously move Election Mail.

• “Hiring. The Postal Service has not implemented a total hiring freeze. EAS hiring was suspended August 7, because of the realignment of our reporting structure. This suspension does not im-pact hiring for craft positions. Craft positions will continue to be filled in accordance with collective bargaining agreements.

• “Retail Hours. The Postal Service will not reduce retail hours be-fore the November elections. Natural disasters, civil unrest, or lack of employee availability due to the coronavirus pandemic may necessitate temporary changes, but local managers are not permitted to reduce retail hours without review and approval by both Area and Headquarters management.

• “Collection Boxes. The Postal Service has suspended the removal of any collection boxes until after the 2020 elections. There may be temporary removal or covering of boxes due to extreme weather, national security incidents, or local events such as wild-fires or civil unrest. It is critical that any collection boxes dam-aged – for example, by hurricane or a car accident – be reported and replaced as soon as possible.

• “Late and Extra Trips. Late or extra trips have not been banned; they should not be restricted if they are reasonably necessary to complete timely mail delivery. Managers are authorized to use their best business judgment to meet service commitments. Focusing on the transportation schedule does not mean that mail should be left behind – it should not. Instead, processing and transportation schedules should be aligned to help reduce late deliveries and unnecessary costs.

• “Mail Processing. No mail processing facilities will be closed or consolidated, and no letter or flat sorting machines will be removed before the November elections. We have more than

Mailers Hub News 3 September 28, 2020 sufficient capacity to process current and anticipated mail volumes with our existing machine supply. Available machines will be returned to service if Headquarters or the Regional Vice President determine that doing so is necessary to fulfill our Election Mail service commitments.

• “Election Mail. We will continue to expedite Election Mail that is entered as Marketing Mail, as is our long-standing practice. Election Mail entered as Marketing Mail should be advanced ahead of all other Marketing Mail and processed expeditiously. To make this possible, please expand processing windows on letter and flat sorting equipment to ensure that all Election Mail received prior to the First-Class Mail Critical Entry Time is processed that same day.” As would be expected, union officials – not the Postal Service – added information about the apparent reversal of policy. Speaking to Seattle’s KUOW, a representative of the American Postal Workers Union in Tacoma declared

“... crosstown mail is being delivered in one day again, while a certified letter to Florida takes three days. Back in July, following

Trump administration efforts at reorganizing the mail service, certified letters were taking nine days to cross the country.” Meanwhile, an electronics technician said that three mail processing machines were being put back in service and that a fourth was to be reconnected soon. “There are no plans to return any of the other three machines at this time, as they were completely disassembled,” he said in an email to

KUOW, without providing the basis for his statement.

Next? If the USPS has been forced to retreat broadly from its plans to get overtime under control, enforce operating plans (in processing as well as transportation), and reduce its inventory of redundant equipment, it remains to be seen whether the situation really will change after the elections are over. Presumably, the legitimacy of improving efficiency, and actions to do so, will be as valid after the elections as before. Next time, however, if the July changes are restored, hopefully DeJoy will have learned about the politics and optics of his actions, and be sufficiently proactive in dealing with perceptions to avoid repeating the fiasco of the past ten weeks.

Wage + Benefit 2020

Print Industries Affiliates’ Wage + Benefits 2020 Survey Open for Submissions

Largest labor report in graphic communications a critical asset in managing an essential workforce

Print Industries Affiliates have announced their Wage + Benefits 2020 Survey,

the industry’s most comprehensive annual report on labor costs and human resource policies of print-related

companies is open for submissions from June 15 through July 31, 2020. From top management to the

shipping department, the Wage + Benefits Survey annually captures labor costs and human resource

practices from nearly 600 firms and more than 17,000 employees across North America.

“Each year, North American Print Industries Affiliates conduct one of the most powerful surveys in the

industry,” commented Teresa Campbell, program director and president of PIA MidAmerica. “2020 has

created many challenges for industry employers in managing employee compensation and human resource

policies. Our annual Wage + Benefits and Human Resource Policies Survey is a joint effort that provides

data critical to print service providers’ ability to recruit, retain, and manage an essential workforce.”

The Wage + Benefit Survey Report, scheduled for release in October 2020, offers wages for most industry

positions in sixteen categories, segmented by region and company size. The report captures policies for

overtime, vacation, PTO, sick time, health insurance, and also includes job descriptions for more than 200

industry positions. New in 2020, the Wage + Benefits Survey makes previous year’s employment data

submissions available automatically upon login to the Wage + Benefits online portal, making the survey

process quick and easy. The online Wage + Benefit dashboard will now offer interactive search and report

capabilities, and questions related to employee impact of COVID-19 have been added to the 2020 survey.

Print Industries Affiliate member participants receive a copy of the published report at no cost. For more

details, locate your local Print Industries Affiliate and access the survey at www.printindustries.org /wages.

Cares Act Summary

On March 27, President Trump signed into law the Coronavirus Aid, Relief and Economic Recovery Act. Read the summary here: Cares Act Summary

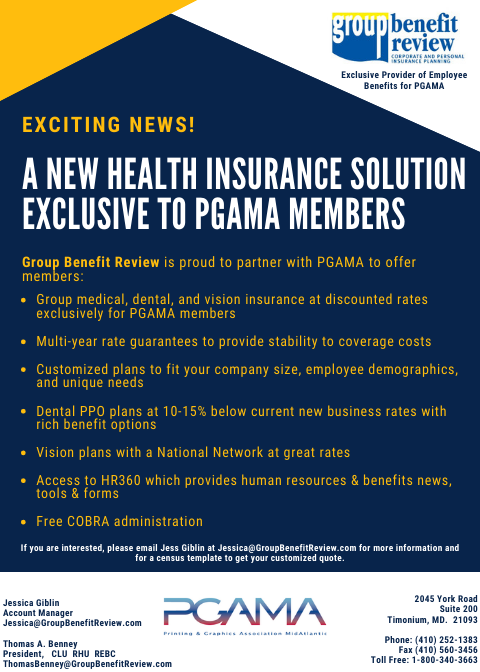

New Health Insurance Solution for PGAMA Members

For a free no obligation quote on group health insurance for your company, complete the quote request form and fill out the census template and send to Jessica Giblin at This email address is being protected from spambots. You need JavaScript enabled to view it..

You can also contact Jessica via email or by phone at 410-252-1383 for more information about how Group Benefit Review can find the right group benefit solution for you!

Oktoberfest

Excellence in Print 2020

Print Production Training

|

|

|

|

|

|

More Articles ...

PGAMA Upcoming Events

Cocktails & Connections09 May 202404:30PM - 07:00PM |

Offices Closed24 May 202412:00AM |

Offices Closed27 May 202412:00AM |

Maryland Golf13 Jun 202408:00AM - |

Offices Closed19 Jun 202412:00AM |

Offices Closed04 Jul 202412:00AM |

Offices Closed05 Jul 202412:00AM |

Search Articles

- Home

- Events

- What We Do

- PGAMA Benefits

- News

- Search