Paper Update 2024

Recent discussions with paper distributors and mill representatives have uncovered some stunning information regarding demand and supply that will impact the printing industry today and in the foreseeable future. Since 2020, there has been a reduction in demand of 47%.

Below is a chart that graphically describes that drop in demand The Blue line is shipments, the Purple is consumption. The reason that they do not align is due to print company inventories that was a byproduct of the Covid era when paper supplies were extremely limited and many companies that could, inventoried.

The determination of the paper mills to balance supply and demand started much earlier than 2020.

Download the full article below.

Paper Update 2024

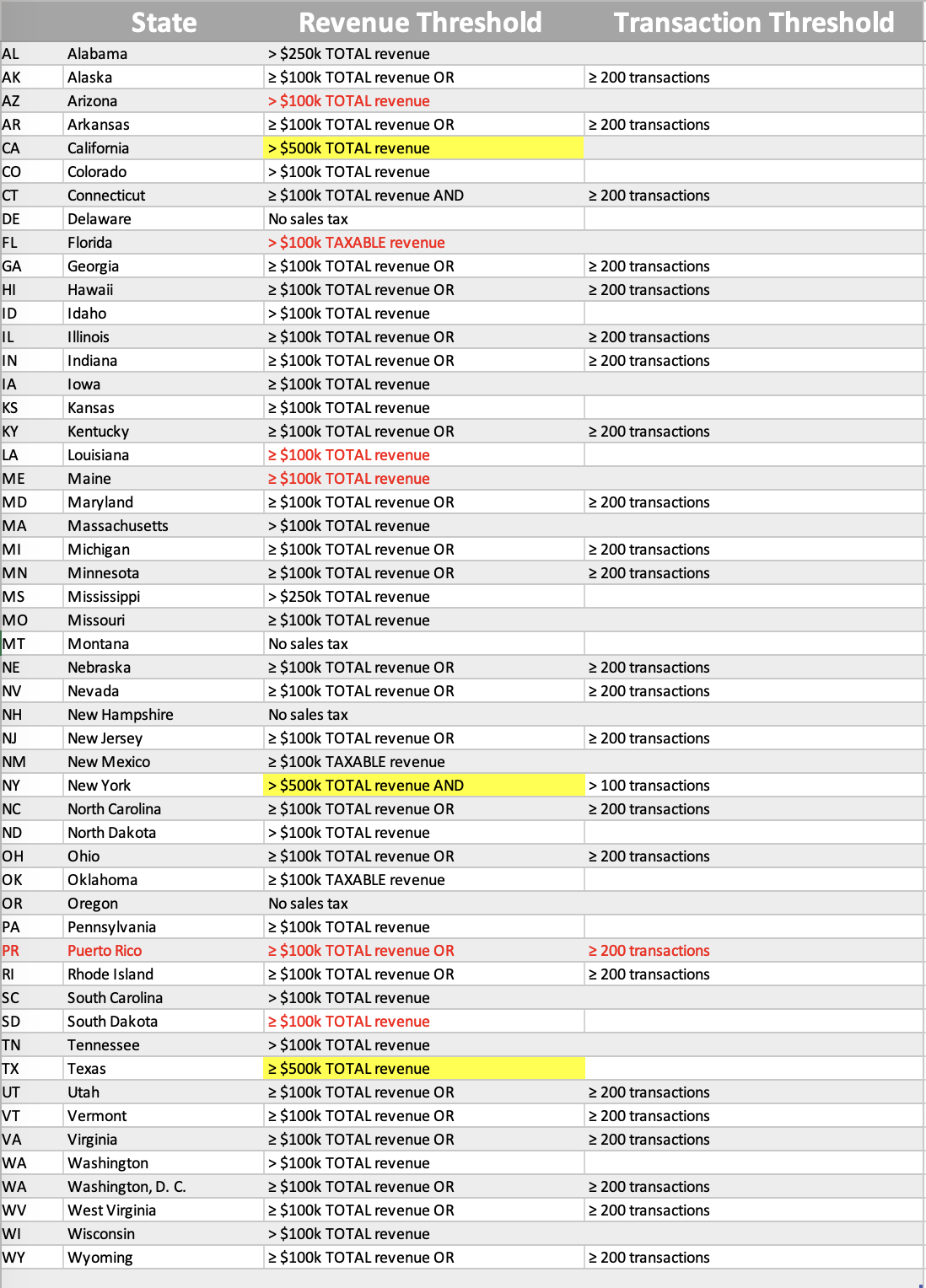

Sales & Use Economic Nexus

As of 1/25/2024

Following the 2018 South Dakota v. Wayfair U.S. Supreme Court decision eliminating the physical presence standard for sales tax nexus, 43 of 45 states with statewide sales taxes have adopted collection and remittance obligations for remote sellers, and 38 have implemented marketplace facilitator regimes. Below please find a chart, developed by PGAMA member, This email address is being protected from spambots. You need JavaScript enabled to view it. of Compass US Accountants and Advisors, for your use.

Final Rule Regarding Independent Contractor Classification

United States Department of Labor Announces Final Rule Regarding Independent Contractor Classification

On January 9, 2024, the United States Department of Labor (DOL) announced the issuance of the final rule,Employee or Independent Contractor Classification Under the Fair Labor Standards Act, effective March 11, 2024. This final rule revises the DOL’s guidance on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act (FLSA) and rescinds a 2021 rule on the same topic. In place of the 2021 rule, this final rule adopts a six-factor test focused on the “economic reality” of the relationship between an employing entity and a worker. The test asks whether, as a matter of economic realities, the worker depends on the potential employer for continued employment or is operating an independent business.

The Significance of the Rule

The definition of independent contractor is significant because it triggers coverage under federal wage and hour law. The FLSA sets federal rules for, among other things, determining when workers are entitled to overtime payments. The distinction between employees and independent contractors determines whether the FLSA applies or not.

Six Factor Test

The final rule affirms that a worker is not an independent contractor if they are, as matter of economic reality, economically dependent on an employer for work. Consistent with judicial precedent and the DOL’s interpretive guidance prior to 2021, the final rule applies the following six factors to analyze employee or independent contractor status under the FLSA:

- opportunity for profit or loss depending on managerial skill;

- investments by the worker and the potential employer;

- degree of permanence of the work relationship;

- nature and degree of control;

- extent to which the work performed is an integral part of the potential employer’s business; and

- skill and initiative.

The final rule provides detailed guidance regarding the application of each of these factors. According to the DOL, no factor or set of factors among this list of six has a predetermined weight, and additional factors may be relevant if such factors in some way indicate whether the worker is in business for themself (i.e., an independent contractor), as opposed to being economically dependent on the employer for work (i.e., an employee under the FLSA).

For more information, the DOL has issuedFrequently Asked Questionsregarding the final rule.

Depending on the Context, Different Tests May Also Apply

One of the most frustrating aspects of independent contractor classification compliance has been that different federal agencies apply different tests – and those tests may differ from state law. For example, California, Illinois, New Jersey, and Massachusetts are among the states that apply a stringent “ABC test.” A worker is considered an employee under the ABC test unless the hiring entity can establish all three of these prongs:

- The worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact;

- The worker performs work that is outside the usual course of the hiring entity’s business; and

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

The ABC test makes it very difficult for many companies to legally classify workers as independent contractors.

What Should Employers Do Now?

Businesses that rely on the use of independent contractors have been and continue to be at risk of having that classification challenged by the DOL or in private litigation. These employers should proactively take steps to mitigate the risk of a misclassification claim, including the following:

- Conduct self-audits or have audits conducted by outside professionals to determine if any workers are misclassified as independent contractors or if any current independent contractors should be reclassified as employees based on the DOL’s final rule.

- Train managers to be issue spotters with regard to wage and hour law best practices, including independent contractor classification.

- Review policies and procedures for any necessary updates.

Lawsuits challenging the new rule are expected, so stay tuned on that front.

Employers with questions about worker classification compliance should consult with experienced human resources professionals and/or labor and employment counsel. For all MEA members, the Hotline is available to provide this assistance. For MEA Essential and Premier members, a Member Legal Services attorney is available for additional consultation.

Amy G. McAndrew, Esquire

Director of Legal and Compliance Services

MidAtlantic Employers' Association

800-662-6238

Time to Review Handbooks in Light of Recent NLRB Ruling

The pendulum is swinging once again at the National Labor Relations Board (“NLRB” or “Board”). In its recent decision in Stericycle, Inc., 372 NLRB No. 113 (2023), the Board largely returned to Obama-era standards for evaluating whether workplace rules infringe on employees’ Section 7 rights under the National Labor Relations Act (“NLRA” or “Act”). Section 7 of the Act gives employees the right to engage in concerted, protected activities. While most employers think of the Board as policing union matters, keep in mind that the NLRB also has jurisdiction over non-union employers and employees.

In Stericycle, the Board majority returned to the standard of a case-by-case review of employer rules and heightened its scrutiny of workplace policies in at least two important ways. First, the new standard focuses on whether a work rule “could” (rather than “would”) be interpreted to chill employees’ Section 7 rights, meaning rules may be deemed illegal even if there are alternative interpretations that are consistent with employee rights. Second, whether a rule implicitly limits protected activities under the new standard will not be considered from the standpoint of a “reasonable” employee. Rather, the Board “will interpret the rule from the perspective of an employee who is subject to the rule and economically dependent on the employer.” This represents a drastic change from Trump-era Board law.

What Should Employers Do Now?

If the Board receives a complaint and ultimately finds one or more of an employer’s work rules to be unlawful under Stericycle, the employer will be required to remove, redact, or replace unlawful policy language and post and distribute notices to employees acknowledging the violation and providing information about their rights under the Act. More importantly, terminating employees according to rules that the Board deems overly broad can result in reinstatement and back pay awards.

Even before the Stericycle decision, it was considered a best practice for employers to establish regular, periodic reviews of their handbooks and workplace rules. In light of the Board’s new standard, employers should conduct such a review now, with a particular eye toward policies that restrict employee speech and actions, as those policies are the most likely to be interpreted as interfering with Section 7 rights. For example, employers should review policies regarding:

- Employee use of social media;

- Criticism of the employer and/or company management;

- Promotion of civility in the workplace;

- Confidentiality of investigations and complaints;

- Disclosure of confidential information, such as terms and conditions of employment;

- Contact with the media and government agencies;

- Solicitation and distribution in the workplace;

- Use of cell phones, cameras and recording devices in the workplace;

- Employee disciplinary rules;

- Use of company communication devices;

- Appearance/dress code; and

- Open-door/internal complaint procedures.

Employers should consult with experienced human resources professionals and/or labor and employment counsel with any questions regarding employment law issues. For all MEA members, the Hotline is available to provide this assistance. For MEA Essential and Premier members, a Member Legal Services attorney is available for additional consultation.

Amy G. McAndrew, Esquire

Director of Legal and Compliance Services

MidAtlantic Employers' Association

800-662-6238

Who is MEA?

MidAtlantic Employers’ Association delivers comprehensive HR-driven business solutions designed to help companies grow. Whether you need support for a single project or complex issues, you have access to seasoned professionals who are experts in their fields and dedicated to serving you well. Our collaborative, accessible, and responsive nature allows us to help you find solutions aligned with your goals. Whatever your goals are, we can help you develop better people and better outcomes so they can be achieved.

To learn more, contact Matthew Roessler, Director of Member Engagement, viaThis email address is being protected from spambots. You need JavaScript enabled to view it.or 201-738-8121.

Wage + Benefits Survey Now Open

Wage + Benefits Study Now Open

On behalf of its more than 3,500 print manufacturer members, Americas Printing Association Network (APAN) has announced its Wage + Benefits Survey is now open for submissions through August 18, 2022. Survey access may be found by going to portal.printindustries.org. The APAN Wage+Benefits Survey is the most comprehensive annual survey of labor costs and human resource policies of print-related companies. From top management to the shipping department, the Wage+Benefits Survey annually captures labor costs and human resource practices from 500 firms and 15,000 employees across North America.

The Wage + Benefits 2023 Survey captures wages for most industry positions in sixteen categories, segmented by region and company size. The survey captures policies for overtime, vacation, PTO, sick-time, health insurance, and includes job descriptions for more than 200 industry positions. The online portal supports participants with multiple locations and makes the previous year’s employment data submissions available automatically upon login, making the process quick and easy.

If you have completed the Wage + Benefits Survey in the past, please use the same email address. Your previous information will be saved and you can just update it. If you have never completed the survey, you will sign up for a new account. Once you do you will receive an email to create a password.

All participants will receive the report for FREE. Click here to take the survey.

ICE Extends Flexible I-9 Rules for Remote Workers Through July 2023

ICE Extends Flexible I-9 Rules for Remote Workers Through July 2023

The United States Department of Homeland Security’s (DHS) Immigration and Customs Enforcement (ICE) agency recently announced an extension through July 31, 2023 of compliance flexibility related to Form I-9 employment eligibility verification requirements. ICE first announced its I-9 flexibility policy in March 2020 for workplaces operating remotely due to the COVID-19 pandemic, and ICE extended the policy numerous times. The policy originally stated that employers would not be required to inspect I-9 documents in the physical presence of employees until the resumption of “normal operations,” and that employers instead would be allowed to review such documents virtually.

With the COVID-19 flexibility policy coming to an end, DHS is now encouraging employers who have been utilizing the flexible inspection procedures to ensure that all required physical inspection of identity and employment eligibility documents is completed by August 30, 2023. This applies to employees hired on or after March 20, 2020 who have received a virtual or remote examination under the temporary flexibility policy.

For fully remote employees, ICE has confirmed that anyone the employer designates may be an “authorized representative” for completing Section 2 of the Form I-9 and the physical document inspection. A representative could include, for example:

- A member of the employee’s household (although this approach presents potential problems);

- A designated agent (like a notary); or

- A third-party agency hired by the employer.

Note that the employer will remain liable for errors or omissions on the Form I-9, regardless of who completes it. Employers who use an “authorized representative” other than a company employee for verification should prepare instructions for their representative and be available to that individual to answer questions during the verification process. Employers also should review the completed I-9 as soon as possible to correct any errors before the employee’s fourth day of employment, thereby reducing any potential employer liability.

In addition, United States Citizenship and Immigration Services has provided guidance on how to annotate a previously completed Form I-9 to note a subsequent physical inspection of identity and employment eligibility documents.

Moreover, the issue of remote verification of I-9 documents likely will be revisited later this year. As a response to the COVID-19 pandemic and its impact on remote work, DHS issued a proposed rule that would allow for alternative procedures for the examination of identity and employment eligibility documents. DHS currently is reviewing public comments and plans to issue a final rule later this year.

Employers should consult with experienced human resources professionals and/or labor and employment counsel with any questions regarding human resources compliance issues. For all MEA members, the Hotline is available to provide this assistance. For MEA Essential and Premier members, a Member Legal Services attorney is available for additional consultation.

For more information on this topic, please join us for our Weekly Town Hall Webinar on July 11 at 11 AM when we will be joined by immigration attorney Chris Thorn of Buchanan. Chris will be discussing this and other immigration issues.

Congratulations to All the Winners!

-

-

HIGHEST HONORS

Grand Q sponsored by Canon Solutions America:

Schmitz Press

Digital Qsponsored by Konica Minolta:

Mt. Royal Printing

Binding & Finishing Qsponsored by Standard Graphics MidAtlantic:

K&W finishing, inc.

Wide Format Qsponsored by Lindenmeyr Munroe:

HBP, Inc.

SPECIAL AWARDS

Best Overall Performance HBP, Inc,sponsored by Heidelberg

Best Use of Color MOSAIC,sponsored by HP

Best Use of Paper Worth Higgins & Associates,sponsored by Lindenmeyr-Munroe

Peoples Choice Ironmarksponsored by K&W finishing, inc.

Judges’ Choice Mount Vernon Printing Company,sponsored by Prisco

Best Use of Photography Schmitz Press,sponsored by Recycling Management Resources

Best Use of Design Mount Vernon Printing Company,sponsored by K&W finishing, inc.

Designers’ Choice Ironmark,sponsored by Atlantic Graphic Systems

Best 4 Color Reproduction Schmitz Press,sponsored by Komori

Nick Mancini Award Paul B. Schmitz,sponsored by PGAMA

BEST OF CATEGORY

| Category |

Process |

Winner |

| Announcements and Invitations |

Digital |

MOSAIC |

| Announcements and Invitations |

Process |

HBP, Inc. |

| Annual Reports; |

Digital |

Ironmark |

| Annual Reports; |

Process |

Schmitz Press |

| Art Reproductions; |

Process |

Mt. Royal Printing |

| Booklets: Large, over 6x9; |

Digital |

The Washington Post |

| Booklets: Large, over 6x9; |

Process |

Worth Higgins & Associates, Inc. |

| Booklets: Small, up to 6x9; |

Digital |

Worth Higgins & Associates, Inc. |

| Booklets: Small, up to 6x9; |

Process |

Schmitz Press |

| Books: Case Bound; |

Digital |

Schmitz Press |

| Books: Case Bound; |

Process |

Schmitz Press |

| Books: Paper Covered; |

Digital |

Heritage Printing, Signs & Displays |

| Books: Paper Covered; |

Process |

HBP, Inc. |

| Brochures & Pamphlets; |

Digital |

Ironmark |

| Brochures & Pamphlets; |

Process |

McClung Companies |

| Calendars; |

Digital |

Schmitz Press |

| Calendars; |

Process |

MOSAIC |

| Catalogs—Company Capabilities; |

Digital |

Ironmark |

| Catalogs—Company Capabilities; |

Process |

Schmitz Press |

| Catalogs—Institutional; |

Digital |

Mt. Royal Printing |

| Catalogs—Institutional; |

Process |

McClung Companies |

| Catalogs—Product-Oriented; |

Digital |

Schmitz Press |

| Catalogs—Product-Oriented; |

Process |

Schmitz Press |

| Die Cutting; |

|

Barton Cotton Graphics |

| Embossing; |

|

Bindagraphics, Inc. |

| Envelopes; |

Non-Process |

Printing Specialist |

| Finishing/Binding; |

|

Bindagraphics, Inc. |

| Folders,Presentation Kits & Portfolios; |

Digital |

Mt. Royal Printing |

| Folders,Presentation Kits & Portfolios; |

Non-Process |

Mount Vernon Printing Company |

| Folders,Presentation Kits & Portfolios; |

Process |

Barton Cotton Graphics |

| Greeting Cards; |

Digital |

Corporate Communications Group |

| Greeting Cards; |

Process |

Mt. Royal Printing |

| Impossible Job; |

|

K & W finishing, inc. |

| Labels (printed—sheetfed); |

Digital |

Worth Higgins & Associates, Inc. |

| Labels (printed—sheetfed); |

Non-Process |

Gamse Lithographing Company, Inc. |

| Labels (printed—sheetfed); |

Process |

Gamse Lithographing Company, Inc. |

| Labels (printed—web); |

Digital |

Gamse Lithographing Company, Inc. |

| Labels (printed—web); |

Process |

Gamse Lithographing Company, Inc. |

| Laser Cutting; |

|

K & W finishing, inc. |

| Magazines; |

Digital |

Worth Higgins & Associates, Inc. |

| Magazines; |

Process |

MOSAIC |

| Maps; |

Process |

Williams & Heintz Map Corporation |

| Miscellaneous; |

Digital |

Schmitz Press |

| Miscellaneous; |

Process |

Ironmark |

| Newsletters; |

Process |

Schmitz Press |

| Packaging; |

Non-Process |

Worth Higgins & Associates, Inc. |

| Packaging; |

Process |

Independent Can Company |

| Point-of-Purchase Material; |

Process |

Worth Higgins & Associates, Inc. |

| Postcards & Self-Mailers; |

Digital |

Schmitz Press |

| Postcards & Self-Mailers; |

Process |

Peabody Press |

| Posters |

Digital |

Worth Higgins & Associates, Inc. |

| Printers' Self-Advertising; |

Digital |

Worth Higgins & Associates, Inc. |

| Printers' Self-Advertising; |

Process |

MOSAIC |

| Programs; |

Digital |

MOSAIC |

| Programs; |

Process |

Schmitz Press |

| Sales Campaigns; |

Digital |

Corporate Communications Group |

| Sales Campaigns; |

Process |

Mount Vernon Printing Company |

| Stamping; |

|

K & W finishing, inc. |

| Stamping/Embossing/Die Cutting Combo; |

|

Bindagraphics, Inc. |

| Unique Direct Mail Solutions; |

Process |

Mount Vernon Printing Company |

| Vinyl Binders; |

|

Bindagraphics, Inc. |

| Web Press Printed Piece Heat Set; |

Process |

H.G. Roebuck & Son, Inc. |

| Website Design; |

|

Strategic Factory |

| Wide Format - Displays; |

|

Heritage Printing, Signs & Displays |

| Wide Format - Signs; |

|

HBP, Inc. |

| Wide Format - Unique Application/Installation; |

|

HBP, Inc. |

| Wide Format - Unique Substrates; |

|

Heritage Printing, Signs & Displays |

| Wide Format - Wraps; |

|

Strategic Factory |

|

|

|

|

|

|

Thank you to our sponsors

|

|

NLRB Says Your Severance Agreements May Violate Federal Law

The National Labor Relations Board Says Your Severance Agreements May Violate Federal Law

The swinging pendulum at the National Labor Relations Board (NLRB or the Board) continues, with the current Board overruling cases that were decided during the Trump administration (some of which overruled precedent from the Obama administration). In the recently decided case McLaren Macomb (372 NLRB No. 58), the NLRB set its sights on confidentiality and non-disparagement provisions in severance agreements. All employers – including those without unions – should take note of and are affected by this latest decision.

In McLaren, the NLRB found that the employer violated the National Labor Relations Act (NLRA or the Act) by presenting employees with a severance agreement containing confidentiality and non-disparagement provisions that, according to the Board, restricted employee rights under the Act. Importantly, the Board’s decision in McLaren Macomb applies only to severance agreements presented to nonmanagerial employees. The NLRA defines a “supervisor” (i.e., a manager) by considering factors that include, but are not limited to: whether the employee has authority to hire, fire, discipline, or responsibly direct the work of other employees.

The Board found the non-disparagement provision at issue violated employees’ NLRA Section 7 rights because “[p]ublic statements by employees about the workplace are central to the exercise of employee rights under the Act.” Similarly, the Board found that the confidentiality provision at issue violated employees’ Section 7 rights because it precluded employees from “disclosing even the existence of an unlawful provision contained in the agreement,” which, the Board argued, could persuade employees from filing unfair labor practice charges or assisting the NLRB in an investigation. The Board also determined the confidentiality provision to be unlawful because it prohibited employees from discussing the severance agreement with current or former coworkers, including those who may receive similar agreements, union representatives or other employees seeking to form a union.

WHAT SHOULD EMPLOYERS DO IN THE WAKE OF THE MCLAREN DECISION?

The McLaren decision makes clear that the Board will closely scrutinize whether the language of severance agreements restricts employees’ NLRA rights. Given this decision, employers should consider taking one or more of the following actions to minimize risk when offering severance agreements with confidentiality and non-disparagement provisions to non-supervisory employees:

- Assess the value of including confidentiality and non-disparagement clauses in the agreement at all and consider whether such clauses can be narrowly tailored so as not to violate employee rights under the NLRA.

- If a severance agreement contains confidentiality and non-disparagement clauses that might be interpreted as restricting employee rights, those restrictions should be as narrow as possible and make explicit that the agreement is not intended to preclude employees from asserting their rights under the NLRA.

- If including confidentiality and non-disparagement provisions, be sure to include “severability” language so that, even if a court or the Board ultimately finds these clause to be unlawful, the remainder of agreement will be enforceable.

Employers should consult with experienced human resources professionals and/or labor and employment counsel with any questions regarding the use of severance agreements with departing employees. For all MEA members, the Hotline is available to provide this assistance. For MEA Essential and Premier members, a Member Legal Services attorney is available for additional consultation.

Amy G. McAndrew, Esquire

Director of Legal and Compliance Services

MidAtlantic Employers' Association

800-662-6238

Update Your Employee Handbook

‘Tis the season—to update your company's employee handbook

An outdated handbook can be a liability, particularly for multistate employers with a widely-dispersed work force.

With 2023 around the corner, now is the time for employers to consider updating their employee handbooks. Handbooks, handed out at orientation and often thereafter ignored, are an important compliance tool for employers addressing all manner of employment issues. And handbook policies can be a helpful tool when defending a variety of employment claims, such as wage and hour violations, harassment and discrimination lawsuits, and leave disputes.

An outdated handbook however, can be a liability, particularly for multistate employers with a widely-dispersed work force. These employers in particular must be attuned to the myriad of different employment laws and must be aware of new developments in any states where any employee is located. These complicated compliance requirements may seem tedious or burdensome, especially in an environment where employers are already struggling with recruiting and hiring, but failure to do so can be costly.

Below, we highlight a few particularly key and nuanced issues to assess when deciding whether to update some of the most-referenced sections in any handbook - the paid leave policy, the expense reimbursement policy, and the anti-harassment and discrimination policies.

Paid Leave

The past year saw increasing calls for paid leave laws to be enacted at both the state and local level. And new paid leave laws have come into effect in several states in 2022, like New Mexico's Healthy Workplaces Act. Indeed, at least 11 states and municipalities have enacted paid leave laws and others are likely to follow. Consider these factors when assessing whether your leave paid policies may be in need of an update:

| 1. |

Pay attention to where employees are located and headcount. Depending on the laws in those jurisdictions, consider a state or local supplement to the main handbook to account for the nuances under greatly differing paid leave laws, which may apply depending on how many employees you have in a particular state.

|

| 2. |

Clearly explain employee eligibility. Federal law requires employers provide FMLA leave after one year on the job and 1250 hours worked and state and local requirements may require leave after less time on the job (e.g., Wisconsin's unpaid FMLA law only requires 1000 hours in the preceding 52 weeks). However, employers can also offer leave at any point before those requirements kick in. Ensure that your policy clearly explains when an employee may be eligible for various paid leaves and ensure that if such leave is protected by law, the policy is compliant.

|

| 3. |

Make sure your leave policies are not inadvertently discriminatory. For example, parental leave policies should apply equally to all types of new parents, although there is an important distinction to be made between paid leave for recovering from childbirth and paid leave for bonding or other non-medical reasons.

|

Expense Reimbursement

While federal law only requires that employers reimburse employees for expenses that bring an employee's earnings below the federal minimum wage, state and local laws vary greatly in the treatment of worker expenses and reimbursement. California, Illinois, Iowa, Massachusetts, Montana, New York and the District of Columbia require that employers reimburse employees for various work-related expenses. And further, several of those states consider expense reimbursement wages subject to the same timing requirements as regular payroll.

Lawsuits for failure to properly reimburse employees for expenses are rapidly increasing in these states and for all manner of expenses ranging from typicalwork-related expenses such as telephone and internet fees and the cost of office supplies, to the extra cost of energy to heat or cool a house. Expense reimbursement also raises questions regarding the ultimate ownership of devices and equipment, especially when employment ends. To address these issues, a good expense reimbursement policy clearly provides:

| 1. |

what expenses are reimbursable and by when the employer will reimburse the employee (applicable state law will govern these and set floors for reimbursement);

|

| 2. |

who owns the devices or equipment; and

|

| 3. |

how the equipment is handled when the employment relationship terminates (will they be wiped of company information and the employee can keep them, must they be returned, etc.?).

|

Protected Characteristics

Over the last several years, state and local authorities have expanded definitions of protected characteristics. At least 18 states and many municipalities have added protections for natural and protective hair styles, for example. Moreover, medical or recreational use of marijuana is now legal in 26 states. Several of those states such as Connecticut, Montana, Nevada, New Jersey, New York, and Rhode Island provide protections for employees that participate in off-duty recreational use of cannabis products and therefore limit an employer's ability to refuse to hire or take adverse action against those workers.

While catch-all language to include additional protected characteristics, such as "and any other characteristic protected by federal, state, or local law," is a common solution, adding the particular protected characteristic to the policy - and better still to harassment and discrimination training - can serve as a defense against liability.

At a minimum, every handbook should contain an Anti-harassment and Ani-Discrimination Policy that:

| 1. |

provides the state and local-specific characteristics that are protected from unlawful harassment and discrimination;

|

| 2. |

has a reporting procedure providing multiple reporting avenues for individuals to make complaints about harassment; and

|

| 3. |

emphasizes the employers commitment to maintaining a workplace free from such unlawful conduct.

|

Finally, Remember the Basics:

-

Use plain language.

-

Set clear expectations for attendance, conduct, and discipline.

-

Include that the handbook is not a contract of employment and does not modify the at-will nature of employment.

-

Include that the policies within the handbook may be revised, modified, or revoked at any time, with or without notice.

-

Make sure that the company retains discretion and flexibility when making decisions.

-

Ensure that you actually follow the policies!

If policies are outdated or no longer followed, that's a clue that your handbook needs a thorough update.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Two Winners in Americas Print Awards

Two entries from Excellence in Print were winners in the Americas Printing Association Network’s (APAN) inaugural presentation of the 2022 Americas Print Awards, a national competition that recognizes the absolute finest in printing across the United States. The winning pieces will be on display at Americas Print Show 22 www.americasprintshow22.com in Columbus, Ohio, August 17-19, 2022.

Recipients of the inaugural Americas Print Awards are:

-

BEST SOFT COVER BOOK AWARD – Printing Specialist Corporation, Annapolis Junction, MD for Period Architecture

-

JUDGES CHOICE AWARD – HBP, Hagerstown, MD for 14 Stations at the Crossroads

It's never too early to start collecting entries for next year's Excellence in Print to be held at Martin's West in Woodlawn, MD April 2023