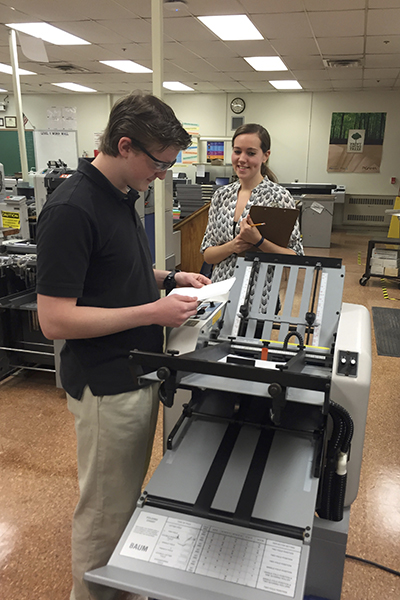

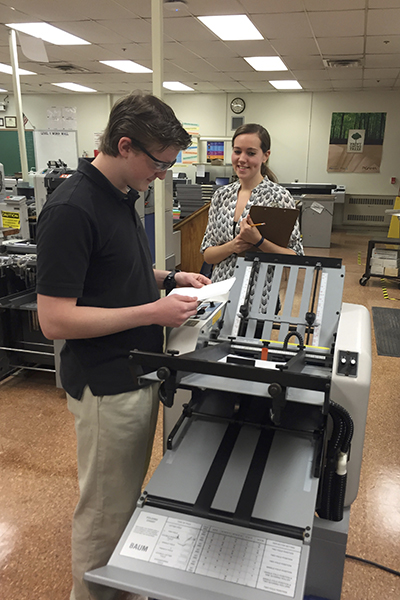

The SkillsUSA Graphic Communications (GC) Competition tests the student's skill and knowledge related to print production. The competition consists of 8 contests covering personal communications, job planning, page layout and preflight skills, printing press operation, digital printing, folding, and technical knowledge.

The SkillsUSA Graphic Communications (GC) Competition tests the student's skill and knowledge related to print production. The competition consists of 8 contests covering personal communications, job planning, page layout and preflight skills, printing press operation, digital printing, folding, and technical knowledge.

The GC competition journey begins at the regional level where students compete with peers in their region. Combined regionals are held at the Center of Applied Technology North (Anne Arundell County) in January and February. The top three scorers from each region earn a chance to compete at the State competition. The regional competitions are a smaller version of the State competition. All regional finalists and their parents are invited to attend the Printing & Graphics Association MidAtlantic's (PGAMA) Excellence in Print Awards Banquet in March as guests of PGAMA.

The GC competition journey begins at the regional level where students compete with peers in their region. Combined regionals are held at the Center of Applied Technology North (Anne Arundell County) in January and February. The top three scorers from each region earn a chance to compete at the State competition. The regional competitions are a smaller version of the State competition. All regional finalists and their parents are invited to attend the Printing & Graphics Association MidAtlantic's (PGAMA) Excellence in Print Awards Banquet in March as guests of PGAMA.

The State GC competition is held in April at Printing Specialist Corporation located in Glen Burnie. The State competition includes more difficult versions of all of the contests held at regionals plus several others. The top three contestants receive prizes (in the past Apple iPads, iPods Touches, and iPod Nanos) with the winner earning the chance to represent the State at the National GC Competition.

The State GC competition is held in April at Printing Specialist Corporation located in Glen Burnie. The State competition includes more difficult versions of all of the contests held at regionals plus several others. The top three contestants receive prizes (in the past Apple iPads, iPods Touches, and iPod Nanos) with the winner earning the chance to represent the State at the National GC Competition.

The National GC Competition is held over 3 days in June in Louisville, KY. At the national level students compete in all of the GC competition contests. The winner of the national competition is elegible to compete in the World Skills competition held every 2 years at a different location around the world.

The National GC Competition is held over 3 days in June in Louisville, KY. At the national level students compete in all of the GC competition contests. The winner of the national competition is elegible to compete in the World Skills competition held every 2 years at a different location around the world.

Maryland has won 3 straight gold medals at the National GC competition including 2 by Chandler Kerr from the Center of Applied Technology North and Brittany Whitestone from Carroll County Career and Tech. Who will be the next GC competition champion?

December 7, 2016

Balanced Approach Will Benefit Maryland Workers and Job Creators

ANNAPOLIS, MD – Governor Larry Hogan today announced plans to introduce legislation in the upcoming session of the Maryland General Assembly to provide common sense, balanced paid sick leave benefits that have the potential to cover nearly all working Marylanders without placing an unmanageable burden on job creators. During his remarks at a State House press conference, the governor reaffirmed his commitment to common sense policies that will make Maryland a more business-friendly state while ensuring a strong and healthy workforce.

“For the last few years, there has been a great deal of discussion and debate around the issue of paid sick leave in Maryland,” said Governor Hogan. “While all of us agree that more workers need sick leave in Maryland, it would be irresponsible to put a law on the books that unfairly penalizes our state’s job creators. It is clear that, in order to move forward, we must strike a balance between the needs of Maryland’s employees while not hurting our small businesses and continuing to foster a more business-friendly climate in our state.

“A strong majority of Marylanders want to see the state address this issue in a common sense way that benefits our workers while also protecting our small business job creators. We look forward to working with legislators on both sides of the aisle to reach an agreement on a balanced, fair, and common sense approach to paid sick leave.”

The Hogan administration’s proposal contains important provisions to protect Maryland’s small business community. Businesses with 50 or more employees will be required to offer paid sick leave totaling at least 40 hours per year, with the ability for employees to roll over a maximum of 40 hours each year. The proposal also calls for part-time employees to be covered after a minimum of 30 working hours. If a company already has a general leave policy that meets these minimum requirements, the state will not interfere. In addition, the state will honor existing collective bargaining agreements with unions. The 50-employee threshold matches current federal standards under the Family Medical Leave Act and the Affordable Care Act.

Maryland small business job creators with fewer than 50 employees that choose to offer paid sick leave will be eligible for tax relief incentives closely modeled after the top recommendation of the Augustine Commission, a bipartisan panel that identified strategies to improve Maryland’s business climate. These small business owners will be able to exempt the first $20,000 of their income from taxes. The legislation will also provide protection for seasonal industries by exempting workers employed for less than 120 days in a 12-month period.

Governor Hogan is committed to giving Maryland workers the support they need without interfering with the policies of small businesses or putting jobs at risk. The Hogan administration’s common sense proposal would institute a fair and flexible statewide policy that would apply to all 24 jurisdictions and supersede existing policies to ensure consistency and ease of compliance for job creators across the state.

WHAT HAPPENED?

A federal district court in Texas ruled yesterday that the new Fair Labor Standards Act overtime rules will not go into effect on December 1, 2016. The court issued a temporary injunction so it could further consider whether the overtime rules should be permanently blocked.

WHAT DOES THIS MEAN TO EMPLOYERS?

This means that employers are not required to make any changes to their current duties and salary structure to meet the December 1, 2016 effective date of the FLSA overtime rules. Recall that exempt status requires two things: Duties of the employee must meet one of the exceptions, and annual Earnings must meet a threshold of $47,476 or more. If your company has already made the changes to either the duties or the earnings of its employees, here are some options:

- If you have given wage increases to meet the threshold of $47,476 to maintain the exempt status, we suggest leaving those in place for several reasons. First, a slight chance exists that the overtime laws may be effective in the future. Second, it will likely be a morale and HR nightmare to roll-back raises. If, however, you decide to take back the increases, make sure that the employees know that all of these decisions were driven by government and court action, and that in an election year, the circumstances can change very quickly. Transparency about the process will help employees understand what is happening.

- If you have changed the duties to meet the other requirement for exempt status, this is a little easier to manage than wage increases. In most cases in the print industry, this would likely mean that a supervisor or customer service representative was given the ability to exercise discretion and use independent judgment on significant matters. First, if the duties were given to create exempt status (which means the person was also going to earn $47,476), consider leaving the duties in place because this employee will be exempt from overtime. Reassigning duties to create a non-exempt position means that employee is now overtime eligible. Second, if duties are removed or reassigned to create the non-exempt position, consider dropping the salary back to the level it was before the adjustment. Otherwise, the employee will be eligible for overtime at the higher rate.

- If you made no changes to wages or duties, continue to monitor the situation. Strongly consider planning for increases, however, as the new administration may want to create a different overtime regulation

WHAT TO EXPECT GOING FORWARD?

A temporary injunction requires the court to believe that the challenge to the overtime rules has a substantial likelihood of success going forward – which is to say that the injunction may become permanent and the new overtime rules may never take effect.

In addition, the recent elections have resulted in Republican control of both houses of Congress and the Presidency. This is significant, because the new administration could decide to simply withdraw its defense to the Texas lawsuit, and the overtime rules would be defeated immediately.

It is possible, however, that the new administration will support some version of new overtime rules. While President-elect Trump has not spoken about yesterday’s court decision, he has indicated in the past that he is not wholly against the overtime rules, but that he might support an exception for small businesses, and a general delay to the implementation of the rule. Both the House of Representative and the Senate have legislation pending that were proposed by Republicans (who will control Congress for at least the next two years).

These bills, or something similar, may be the future of the overtime rules. Although the legislation differs slightly, if either of these bills were passed, it appears that the salary threshold for exempt positions would increase to approximately $36,000 in annual earnings, and the duties tests would remain the same. The threshold salary amount would be phased with incremental increases occurring over several years, reaching the $36,000 amount approximately three years after the rules went into effect.

HOW DO WE MONITOR THE SITUATION?

PGAMA along with Printing Industries of America, will closely watch what is happening with the FLSA overtime rules and when there is news, will keep members informed by notifying immediately. If you have any immediate questions, please contact This email address is being protected from spambots. You need JavaScript enabled to view it. at 410-319-0900

Post accident drug testing.

Unless lawsuits attempting to overturn the rule or OSHA delays it further, December 1, 2016 is the date for implementation of a rule that employers are not prohibited from drug testing employees who report work-related injuries or illnesses so long as they have an “objectively reasonable basis” for testing. In addition, the rule does not apply to drug testing employees for reasons other than injury reporting. The rule only prohibits drug-testing employees for reporting work-related injuries or illnesses without an “objectively reasonable basis”.

OSHA also said that post-incident drug testing that is consistent with the terms of a state’s Drug-Free Workplace or workers’ compensation statutes, or federal law (such as U.S. Department of Transportation regulations) is not impacted by the rule and is allowed. Testing will be permissible even in the absence of such a state or federal law if an employer’s private insurance carrier offers discounted rates if the employer implements a post-incident drug testing policy. OSHA has also confirmed that random, pre-employment, and reasonable suspicion testing are not covered by the rule.

For post-accident drug and alcohol testing that will be conducted outside of one of the programs that is not covered by the rule, the key is having an “objectively reasonable basis”. OSHA’s focus to determine an “objectively reasonable basis” will be whether the employer had a reasonable basis for believing that drug use by the reporting employee could have contributed to the injury or illness. It will consider factors including whether the employer had a reasonable basis for concluding that drug use could have contributed to the injury or illness (and therefore the result of the drug test could provide insight into why the injury or illness occurred), whether other employees involved in the incident that caused the injury or illness were also tested or whether the employer only tested the employee who reported the injury or illness, and whether the employer has a heightened interest in determining if drug use could have contributed to the injury or illness due the hazardousness of the work being performed when the injury or illness occurred.

For example - A crane accident injures several employees working nearby but not the operator. The employer does not know the cause of the accident, but there is a reasonable possibility that it could have been caused by operator error or by mistakes made by other employees responsible for ensuring that the crane was in safe working condition. In this scenario, it would be reasonable to require all employees whose conduct could have contributed to the accident to take a drug test, whether or not they reported an injury or illness. Testing would be appropriate in these circumstances because there is a reasonable possibility that the results of drug testing could provide the employer insight on the root causes of the incident. However, if the employer only tested the injured employees but did not test the operator and other employees whose conduct could have contributed to the incident, the testing of reporting employees would be seen as a violation.

OSHA also stated that drug testing an employee whose injury could not possibly have been caused by drug use would likely violate the retaliation provision of the rule. For example, drug testing an employee for reporting a repetitive strain injury would likely not be objectively reasonable because drug use could not have contributed to the injury.

In the final rule, OSHA indicated that only drug tests that can indicate impairment at the time of the injury or illness would be permissible. The only test capable of such a determination is an alcohol test. OSHA now says it “will only consider whether the drug test is capable of measuring impairment at the time the injury or illness occurred where such a test is available.” OSHA will consider this factor for tests that measure alcohol use, but not for tests that measure the use of any other drugs. This means that drug testing is allowed even if levels of impairment have not yet been established.

The guidance can be found at https://www.osha.gov/recordkeeping/finalrule/interp_recordkeeping_101816.html

The SkillsUSA Graphic Communications (GC) Competition tests the student's skill and knowledge related to print production. The competition consists of 8 contests covering personal communications, job planning, page layout and preflight skills, printing press operation, digital printing, folding, and technical knowledge.

The SkillsUSA Graphic Communications (GC) Competition tests the student's skill and knowledge related to print production. The competition consists of 8 contests covering personal communications, job planning, page layout and preflight skills, printing press operation, digital printing, folding, and technical knowledge. The GC competition journey begins at the regional level where students compete with peers in their region. Combined regionals are held at the Center of Applied Technology North (Anne Arundell County) in January and February. The top three scorers from each region earn a chance to compete at the State competition. The regional competitions are a smaller version of the State competition. All regional finalists and their parents are invited to attend the Printing & Graphics Association MidAtlantic's (PGAMA) Excellence in Print Awards Banquet in March as guests of PGAMA.

The GC competition journey begins at the regional level where students compete with peers in their region. Combined regionals are held at the Center of Applied Technology North (Anne Arundell County) in January and February. The top three scorers from each region earn a chance to compete at the State competition. The regional competitions are a smaller version of the State competition. All regional finalists and their parents are invited to attend the Printing & Graphics Association MidAtlantic's (PGAMA) Excellence in Print Awards Banquet in March as guests of PGAMA. The State GC competition is held in April at Printing Specialist Corporation located in Glen Burnie. The State competition includes more difficult versions of all of the contests held at regionals plus several others. The top three contestants receive prizes (in the past Apple iPads, iPods Touches, and iPod Nanos) with the winner earning the chance to represent the State at the National GC Competition.

The State GC competition is held in April at Printing Specialist Corporation located in Glen Burnie. The State competition includes more difficult versions of all of the contests held at regionals plus several others. The top three contestants receive prizes (in the past Apple iPads, iPods Touches, and iPod Nanos) with the winner earning the chance to represent the State at the National GC Competition. The National GC Competition is held over 3 days in June in Louisville, KY. At the national level students compete in all of the GC competition contests. The winner of the national competition is elegible to compete in the World Skills competition held every 2 years at a different location around the world.

The National GC Competition is held over 3 days in June in Louisville, KY. At the national level students compete in all of the GC competition contests. The winner of the national competition is elegible to compete in the World Skills competition held every 2 years at a different location around the world.